USE CASES

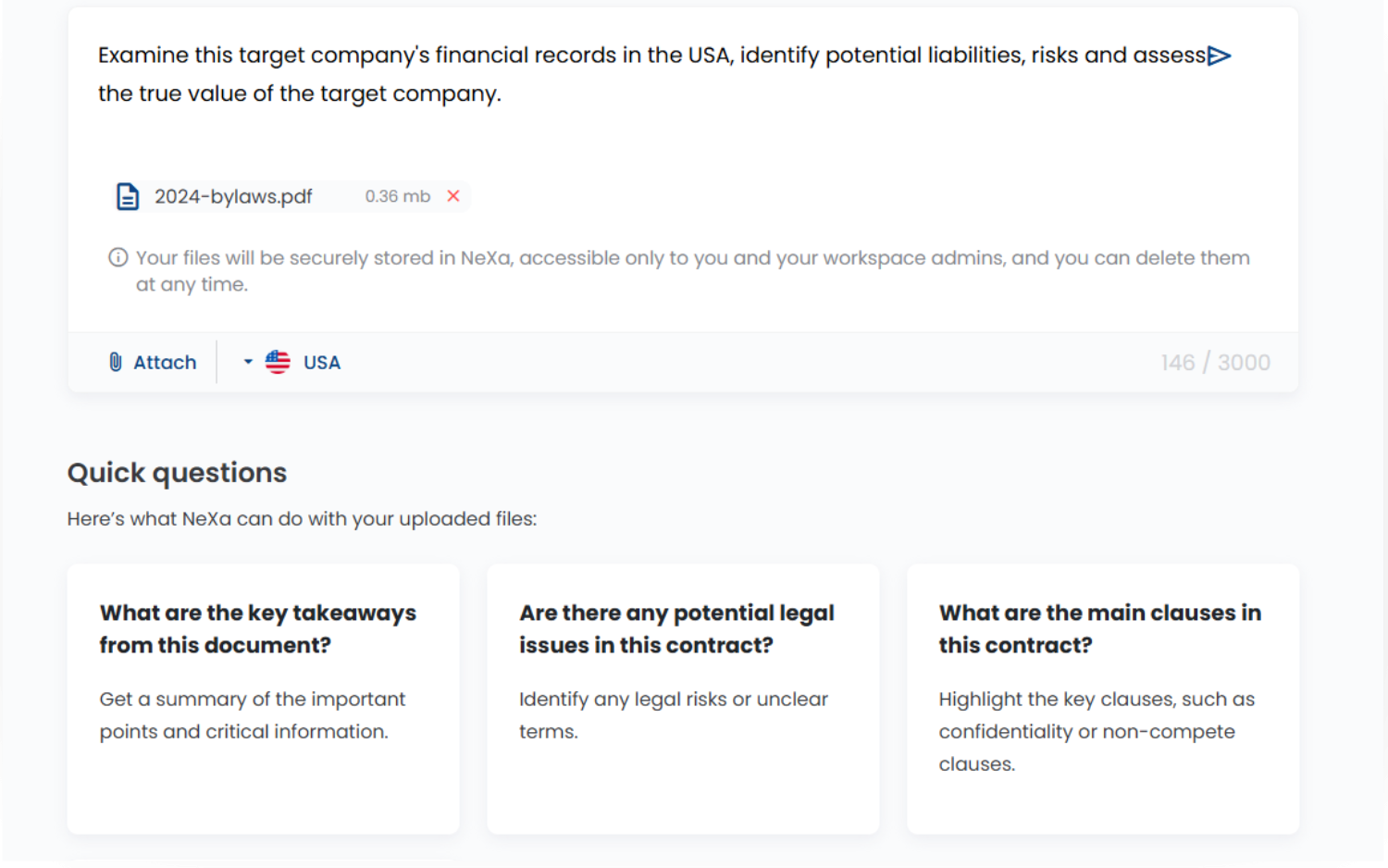

Scenario:

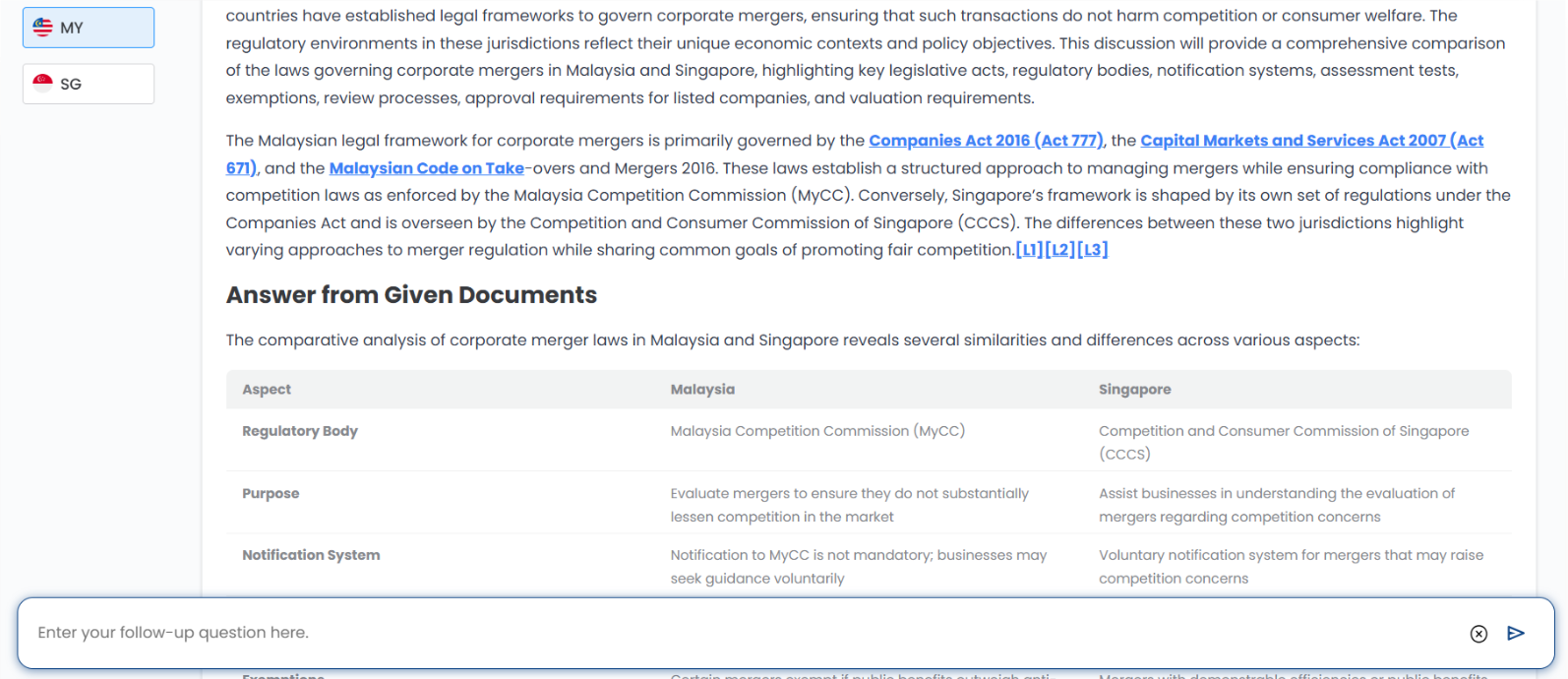

A corporate law firm is assisting a multinational client with a $500 million tech acquisition. The deal requires extensive due diligence to assess risks, intellectual property, and securities law compliance across jurisdictions, all under tight deadlines to review and draft key documents.

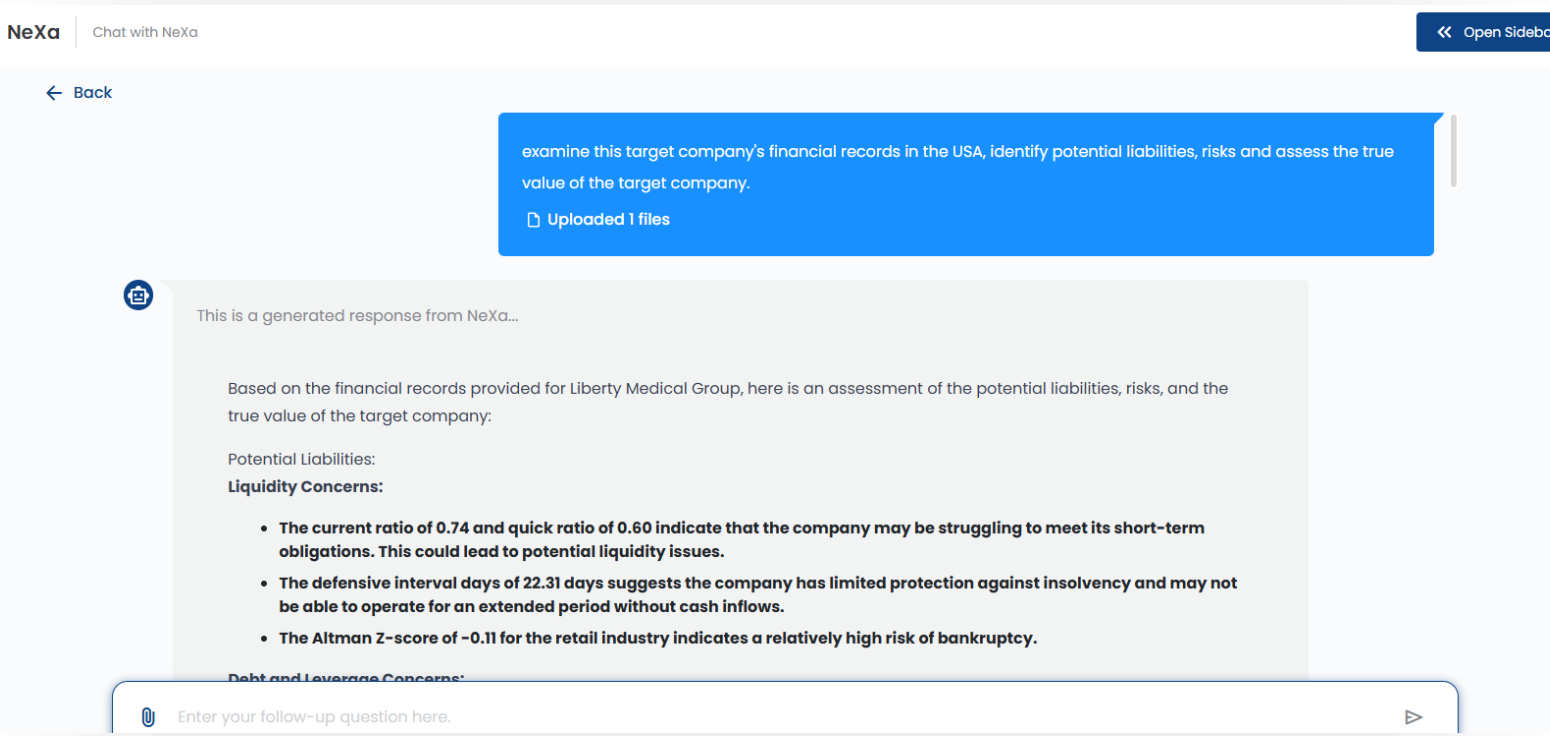

Outcome:

With NeXa, corporate lawyers can handle even the most complex M&A transactions efficiently, focusing on strategy rather than manual document review.